How Accurate is Max Pain in Option Trading?

Joonie Kim

OptionCharts Contributor

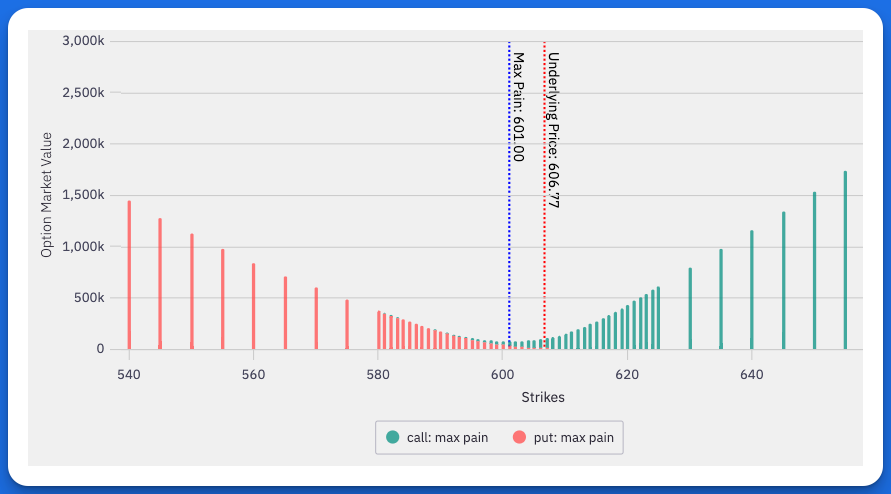

If you’ve been trading options or spending time in trading communities like WallStreetBets or Stocktwits, you’ve probably come across the term Max Pain Theory. It’s a popular idea that gets a lot of attention, especially among retail traders. The theory suggests that as options near expiration, the price of the underlying stock tends to gravitate toward a “Max Pain” price. This is the price that causes the most losses for option buyers while minimizing losses for option sellers, or market makers. Sounds fascinating, right? But how true is it? We decided to dig deeper and find out.

Breaking Down Max Pain Theory

At its core, the Max Pain Theory revolves around the idea that market dynamics, whether intentional or coincidental, push stock prices toward this magical level. The reasoning is simple: option sellers, who often include sophisticated market participants such as big hedge funds, have a vested interest in minimizing their losses. If true, this theory could open the door to profitable trading strategies by exploiting these predictable price movements.

But is it just another market myth, or does it actually hold water? Researchers decided to find out.

Researched and Tested Max Pain

The Max Pain research paper "No Max Pain, No Max Gain: A Case of Predictable Reversal" analyzed U.S. stock and option data spanning 25 years (1996–2021) across NYSE, AMEX, and NASDAQ markets. The researchers rigorously test Max Pain theory and find evidence of predictable price reversals, particularly in smaller market cap and less-liquid stocks, highlighting a potential opportunity for profitable trading strategies.

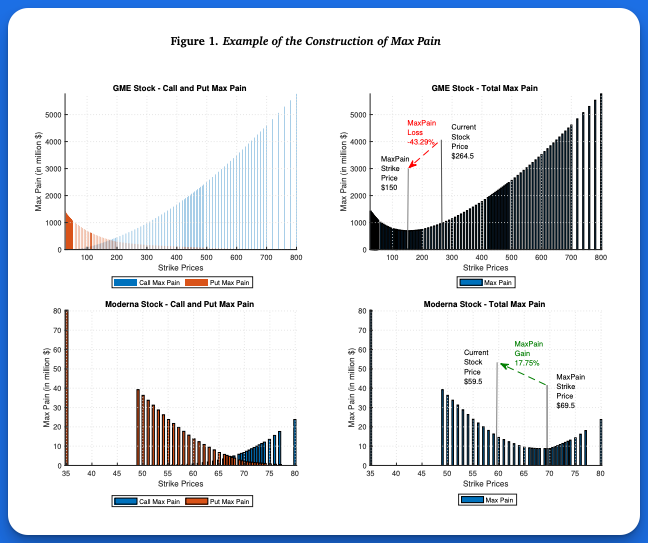

The study focused on creating a Max Pain measure, which compared the current stock price to the predicted Max Pain strike price—the level where sellers’ aggregate losses would be minimized. Using this measure, the researchers built a long-short trading strategy:

- Long positions on stocks expected to rise (high Max Pain scores).

- Short positions on stocks expected to fall (low Max Pain scores).

The strategy was executed one week before options expiration and held until expiration.

The results?

A consistent and statistically significant profit.

The research found that a long-short strategy based on the Max Pain theory generated an average weekly return of 0.4%, with the effect strongest for small-cap and illiquid stocks. Notably, in high Max Pain stocks (when max pain is above the current stock price), prices reversed upward by an average of 0.4% during options expiration week, validating the theory's prediction. The study also observed significantly higher abnormal trading volume and net buying of call options in these stocks, indicating sophisticated investor behavior in anticipation of the price movement.

To put it simply, most of the gains came from stocks in the "high Max Pain" group, or those expected to bounce back upward before expiration.

What Drives These Patterns?

Stocks with high Max Pain scores (expected to rise) often experienced sharp drops in the weeks leading up to the expiration period. Conversely, low Max Pain stocks (expected to fall) saw price increases before slightly cooling off. During the expiration week, these trends reversed in a way that matched the theory’s predictions.

The researchers suggested several possible explanations:

- Stocks often overreact to prior trends, and expiration week seems to be a hot spot for reversals—especially for high Max Pain stocks.

- Market makers, including option sellers, might influence prices to minimize their losses.

- Data showed increased trading volumes and imbalances during expiration week, particularly for high and low Max Pain stocks, indicating that market participants might anticipate these movements.

Why Max Pain Matters for Traders

These price movements aren’t random. The predictable timing of the reversals—specifically during the week leading up to expiration—makes this strategy intriguing. The Max Pain effect was strongest for smaller market cap and less-liquid stocks, which are easier to influence and tend to display more dramatic price movements.

Does Max Pain Always Work?

We wish, haha! The Max Pain strategy in the research paper worked best during expiration week but showed weaker results when tested over longer periods or with larger-cap stocks. Also, the effect didn’t apply to index options, likely because indices are harder to manipulate and less prone to dramatic price swings.

Final Thoughts: Is Max Pain Accurate?

The research suggests that the Max Pain Theory has merit, especially for savvy traders who can spot patterns and time their trades. We found that the Max Pain value is most effective when analyzing smaller-market-cap, less-liquid stocks in a one-week timeframe. Whether you're a beginner exploring options or an experienced trader looking for an edge, understanding Max Pain dynamics could be a valuable addition to your trading toolbox.

So, next time you’re trading around options expiration, keep an eye on the Max Pain level. It might just help you profit from one of the market’s quirks.

View Max Pain on OptionCharts here!

Sources

- Filippou, Ilias and Garcia-Ares, Pedro Angel and Zapatero, Fernando, No Max Pain, No Max Gain: A Case of Predictable Reversal (June 18, 2022). Boston University Questrom School of Business Research Paper No. 4140487, Available at SSRN: https://ssrn.com/abstract=4140487