IV Rank Added to Market Trends

OptionCharts Team

We recently added IV rank to our market trends charts. The IV (Implied Volatility) Rank is a financial metric designed to help traders and investors evaluate the current level of implied volatility in relation to its historical range. This tool allows users to assess whether options are relatively expensive or inexpensive, aiding in decision-making for various trading strategies. IV Rank is widely used for identifying opportunities, managing risk, and optimizing strategies in the options market.

How is IV Rank different from regular IV?

IV Rank is a comparative metric, while regular IV (Implied Volatility) is an absolute measure. Regular IV reflects the market’s expectation of a stock’s future price movement, expressed as a percentage over a specific period. In contrast, IV Rank measures where the current IV stands relative to its historical range, typically over the past year. This distinction helps traders understand not just how volatile a stock might be, but whether the current level of volatility is high, low, or average compared to its past behavior.

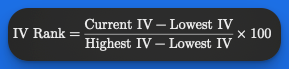

How is IV Rank calculated?

IV Rank is calculated by comparing the current implied volatility (IV) of an asset to its historical range over a specified period, typically one year. Here’s the formula:

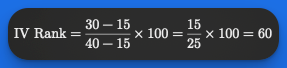

Let's look at a real example:

- Current IV: 30%

- Highest IV (past year): 40%

- Lowest IV (past year): 15%

An IV Rank of 60 means the current IV is higher than 60% of all IV readings from the past year. This helps answer critical trading questions like, "Is this put option overpriced?" or "Are these calls a good deal right now?"

Think of IV Rank like a thermometer for option prices - it helps you judge if premiums are running "hot" or "cold" compared to their normal range.

When to use IV Rank in options trading?

When IV Rank is high, it indicates that options are relatively expensive, making it an ideal time for strategies like selling options (e.g., credit spreads or iron condors) to capitalize on the higher premiums. Conversely, when IV Rank is low, options are less expensive, making it a good time to buy options (e.g., long calls or puts) to benefit from potential increases in volatility. By using IV Rank, traders can better assess market conditions and align their strategies with the current volatility environment.

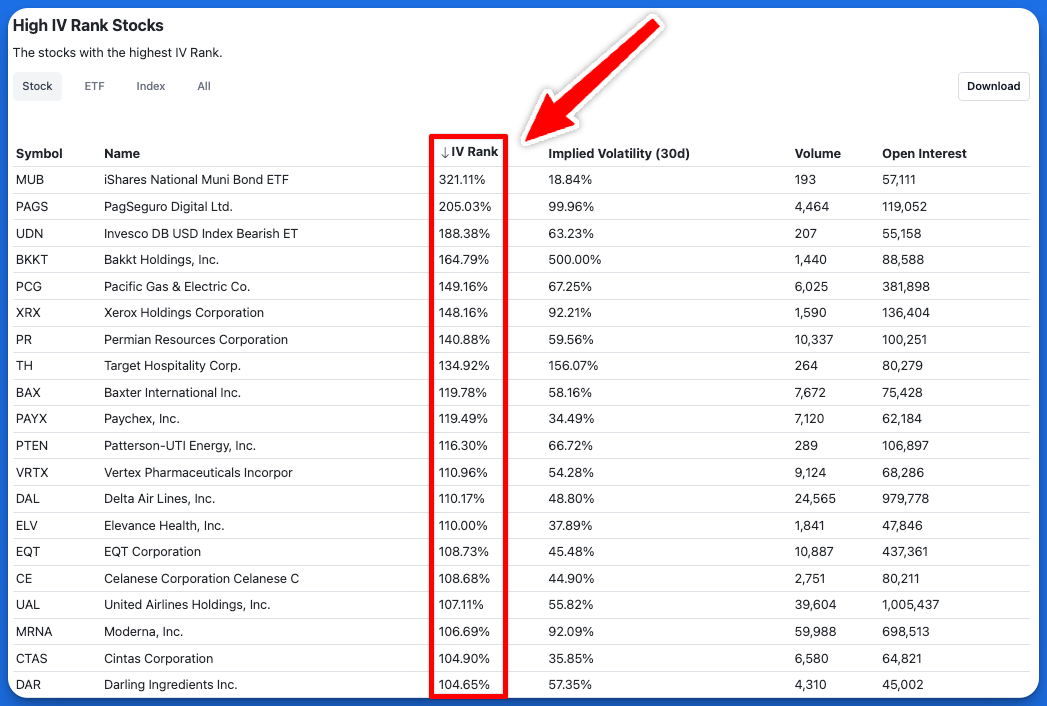

How to find IV Rank on OptionCharts

Find the "Market Trends" tab.

Find the "High IV rank" tab.

View the IV Rank column.

You can view high IV rank by Stock, ETFs, Indexes, or all of the above.