Understanding Open Interest in Options Trading

Option Open Interest (OI) represents the total number of outstanding option contracts that have not been settled.

What is Open Interest?

Open Interest is a key metric in options trading, providing valuable insights into market activity and liquidity. Traders and investors often use open interest in combination with other indicators to make informed trading decisions. Open interest represents the total number of open option contracts that can be exercised and that haven't yet been closed out.

How is Open Interest Calculated?

- When a buyer or seller creates a new contract, Open Interest increases by one.

- When an existing contract is closed by either party, Open Interest decreases by one.

- If a contract changes hands between buyer and seller, but isn't closed, Open Interest remains the same.

How to Use Open Interest in Options Trading?

- High Open Interest indicates greater liquidity, which means it's easier to enter or exit positions.

- Rising Open Interest combined with price movement can help gauge market sentiment.

- Increasing Open Interest with rising prices signals a bullish sentiment.

- Increasing Open Interest with falling prices signals a bearish sentiment.

- Changes in Open Interest, when analyzed alongside price and volume, can confirm breakout or reversal patterns.

Open interest reveals valuable information about market sentiment and trading activity.

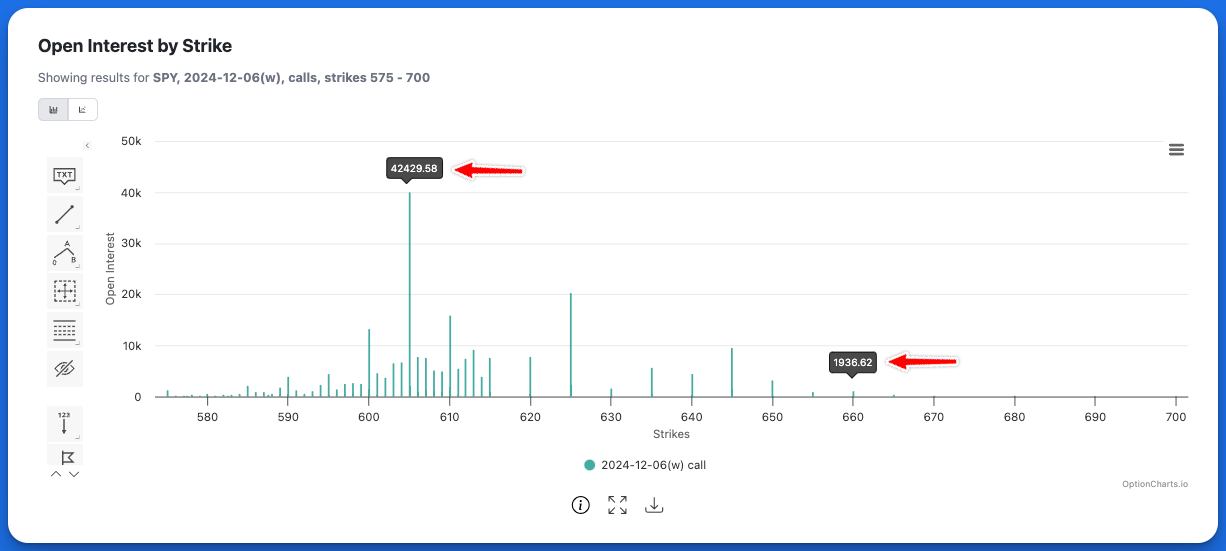

Let's look at an example using real SPY options data:

SPY options data showing open interest distribution

Key Observations:

- ~42,000 contracts are open at $605 strike

- ~2,000 contracts are open at $660 strike

This distribution suggests market participants view the $660 strike as unlikely to be reached—it's too far from the current price. The concentration of open interest between $600 and $615 indicates traders expect the price to settle within this range, though markets can always surprise us.

This tells us that open interest can be a good clue about where most traders or market makers think prices might go and which options are easier to trade.

How Often is Open Interest Updated?

Open interest is updated once a day and is available on OptionCharts at regular market open, which is 9:30 AM EST for real-time data subscribers, or 9:45 AM EST for standard users.

Open interest shows the total number of outstanding option contracts from the previous trading session. The Options Clearing Corporation (OCC) calculates these figures at the end of each trading day after reconciling all trades from the previous session. These figures typically are not finalized until market open the following day.

Using Open Interest with OptionCharts

OptionCharts provides powerful visualization tools to help traders analyze Open Interest data quickly and efficiently. Our platform offers several key features:

User-Friendly charts

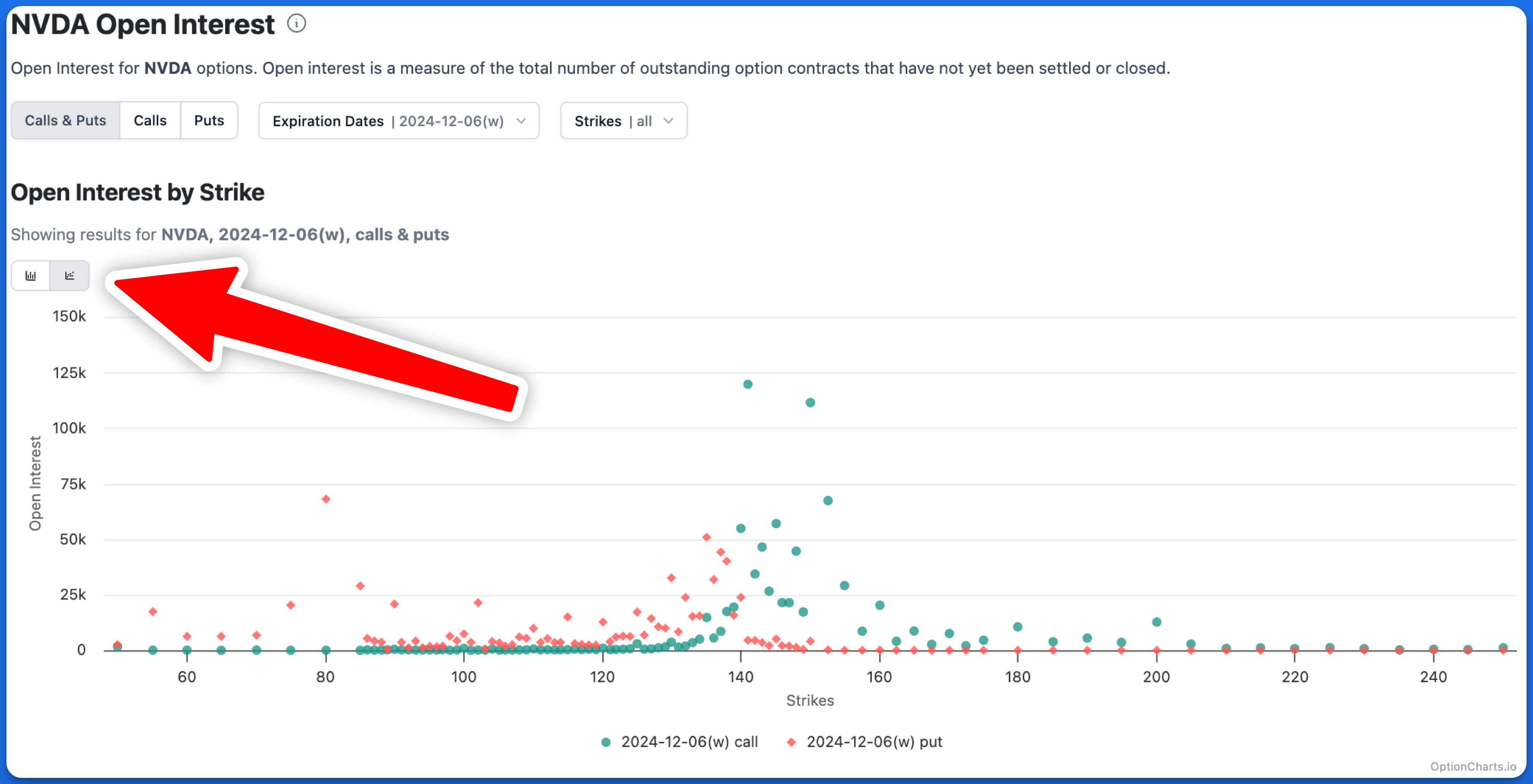

- Multiple chart types available: column, scatter, and line charts

- Clear, easy-to-read distribution of Open Interest across strikes

- Charting optimized for options analysis

Reliable Data

- Authorized OPRA (Options Price Reporting Authority) data vendor

- Accurate, institutional-quality options data

Flexible Analysis

- Filter options by calls and puts

- Analyze multiple expiration dates simultaneously

- Filter by strike prices to focus on relevant data

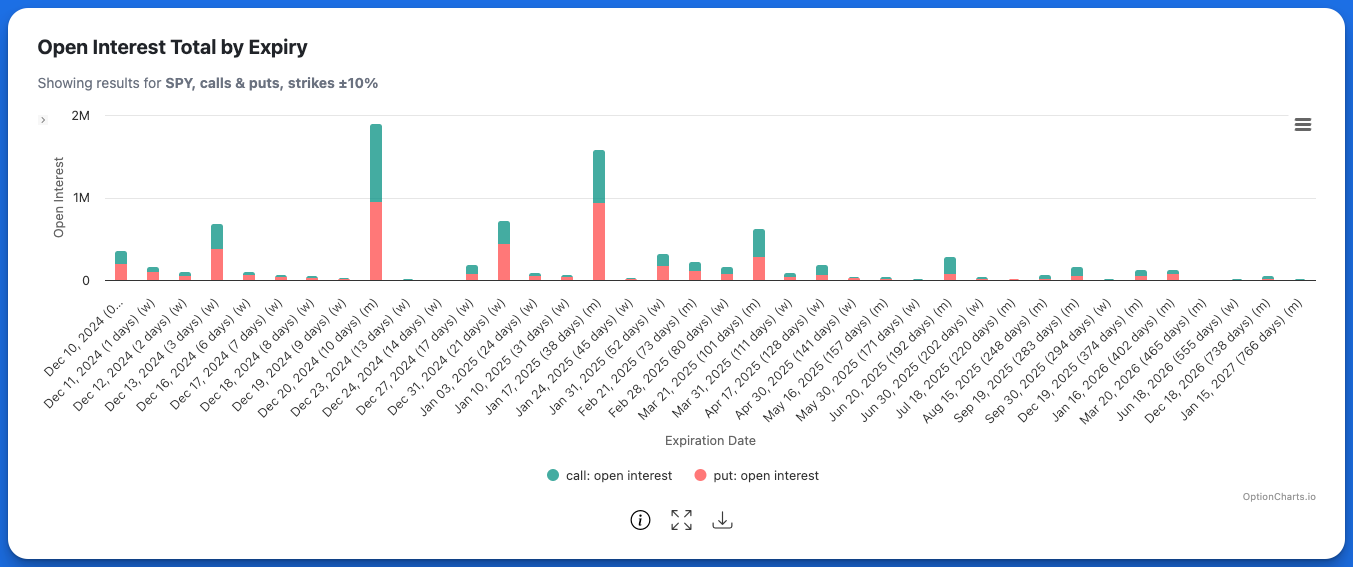

Analyze open interest across multiple expiration dates

Multiple visualization options for Open Interest analysis

Charts for viewing Open Interest

Our platform offers three charts for Open Interest analysis:

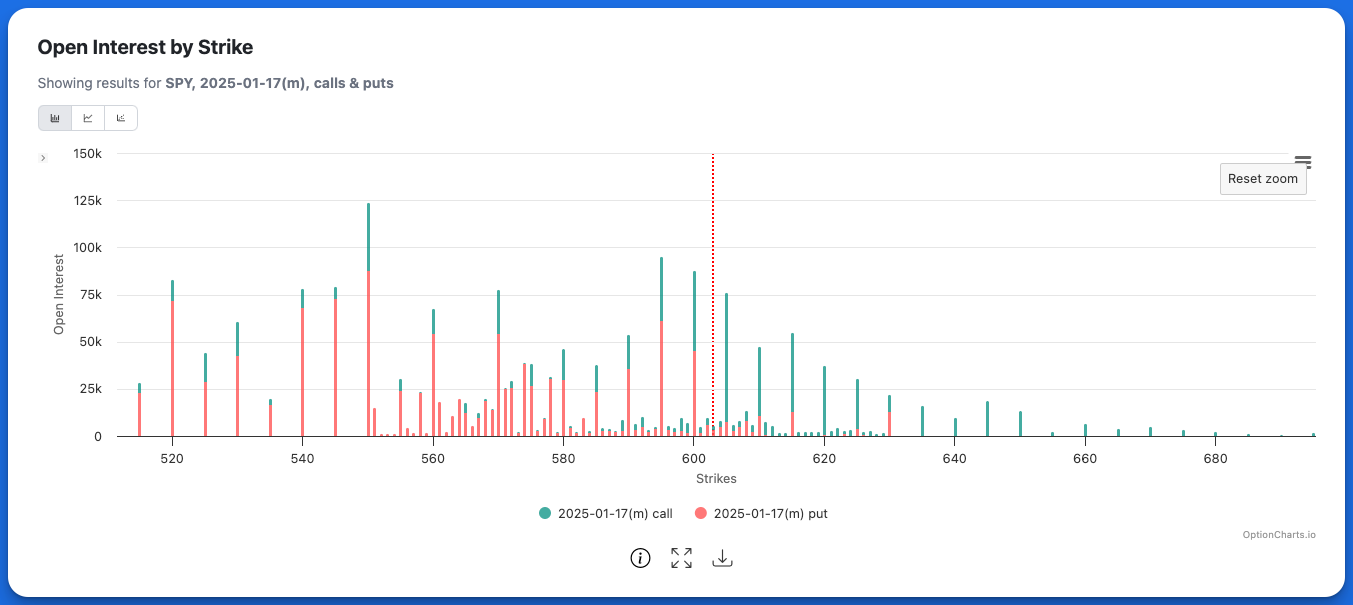

Open Interest by Strike

Visualizes the distribution of Open Interest across different strike prices

Open Interest by strike

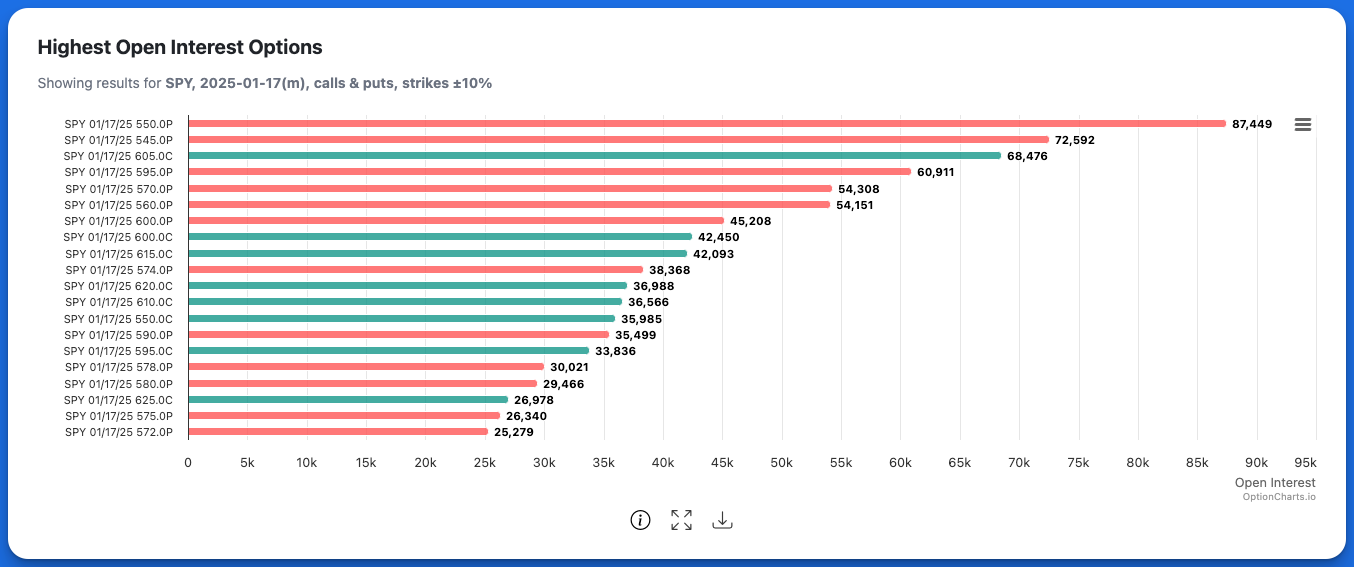

Highest Open Interest Options

Shows option contracts with the largest Open Interest. Quickly identify the top contracts by open interest across selected expirations or strikes.

Highest Open Interest contracts

Open Interest Total by Expiry

Displays total Open Interest across different expiration dates. This helps to understand where market participants are focusing their attention.

Open Interest total by expiry

Key Takeaways

- Open Interest is a crucial metric for understanding market liquidity and sentiment.

- Open Interest is updated daily by the OCC after the market closes.

- High Open Interest typically indicates higher liquidity and easier entry/exit for positions.

FAQs

What does open interest tell you?

Open Interest reveals the level of market activity and sentiment in options and futures trading. It indicates liquidity, the strength of trends, and whether new positions are being created or closed. Rising Open Interest often confirms strong trends, while declining Open Interest suggests weakening momentum or consolidation. Combined with price and volume, it helps validate market movements and informs trading decisions.

Does high Open Interest always mean high liquidity?

Open Interest is neither inherently good nor bad; its significance depends on how it aligns with market trends and trading strategies. High Open Interest generally indicates strong market participation and liquidity, which can be beneficial for trading. However, its impact varies based on price movement—rising Open Interest with a price increase may confirm bullish trends, while with a price drop, it signals bearish sentiment. Understanding the context is key to leveraging Open Interest effectively.

What happens when Open interest rises?

When Open Interest rises, it indicates that new contracts are being created, reflecting increased market participation and interest. This often strengthens existing trends, with rising prices signaling bullish sentiment

What happens when Open interest falls?

When Open Interest falls, it indicates that existing contracts are being closed, reflecting reduced market participation. This often signals weakening trends or market consolidation, as traders exit their positions.

What is the difference between open interest and volume?

Open Interest and Volume are both key metrics for analyzing market activity, but they measure different aspects. Open Interest represents the total number of outstanding contracts that are active and have not been settled or closed, providing a snapshot of overall market participation. On the other hand, Volume measures the total number of contracts traded during a specific time period, reflecting the day-to-day trading activity.

While Open Interest shows the cumulative state of the market, Volume captures the flow of activity, making them complementary tools for assessing market trends and liquidity.